BCN Member Version – Login Required (PDF)

I. Welcome & Introductions

Tom Tidwell called the meeting to order at about 6:45 PM. A quorum was present.

II. Approval of Minutes

Minutes for the December meeting, with revisions, were approved.

III. Admit New Member Neighborhoods

No neighborhoods asked to be considered for BCN membership.

A BCN Neighborhood Census form was distributed at the meeting. All BCN neighborhoods are requested to complete the form. The form ensures that BCN has contact information for each neighborhood and explicit identification of each neighborhood’s BCN representative and alternates.

IV. Election of 2016 BCN Officers

Elections for 2016 BCN officers were conducted by online votes by 15 BCN neighborhoods. All the incumbents stood for reelection. While write-in votes were permitted for all offices, none were cast and all officers were reelected unanimously, as follows:

Chairman: Tom Tidwell, West Paces Northside

Vice-Chairman: Ron Grunwald, Loring Heights

Secretary: Gordon Certain, North Buckhead

Treasurer: Debra Wathen, Paces

Communications: Jeff Clark, Garden Hills

V. BCN Standing Committee Reports

• Communications

No report

• Education:

Tom Tidwell reported on several items related to the Georgia Legislature:

Opportunity School District / State Funding (QBE) – Tom said that one of Governor Deal’s initiatives was the funding of schools. Tom was unsure of the impact on Atlanta Public Schools (APS) but suspects it will be the same or better for the schools without resulting in higher property taxes.

• Development/Infrastructure

City Beltline Payment to APS – Tom said the City was going to be in default of the Beltline agreement as of January 1 since it had not paid APS the required amounts. The city made a $9 million payment on December 31 to avoid default. He said that City Councilmember Felicia Moore had issues with the payment.

City Councilmember Mary Norwood discussed these issues. The basic problem, according to Mary, is that the $9 million payment had not been authorized by the City Council. Felicia determined that a $1.9 million payment was made to APS in 2013 as “Beltline Special TAD Funds”. (The documents Mary referred to in the discussion of this issue have been posted on the BCN web site.). At the end of the City Council budget process in June of 2015, the City Council approved an additional $4 million payment to APS. The City’s $9 million payment in December was called a “Good Faith Payment” to APS and was made from the General Fund, not the Beltline Tax Allocation District (TAD). Mary provided Felicia’s analysis of why $5 million of the payment was not legal. Mary thinks that analysis is correct. At the latest City Council meeting the City’s Law Department and Finance Department, disagreeing with Felicia, took the position that the payments were legal. Mary said the December payment was not disclosed to the City Council in a timely manner even though she said there was ample opportunity to do so. Tom asked what could be done to keep the Mayor from making future payments not approved by the Council. Mary said that the City needs to put its financial books (accounts payable & accounts receivable) online like other cities have done. As it stands today according to Mary, “The Council does not see the books.”

Zoning Ordinance Rewrite – Mary continued, switching to the topic of zoning. She handed out an analysis of the strengths and weaknesses of the current system prepared by a task force led by Bob Zoeckler, Aaron Fortner, and Caleb Racicot. Mary was pleased with the approach: rather than rewriting the zoning code and soliciting public feedback, the current effort is to prepare an assessment of the code to guide future actions.

Click Here to see the ATL Zoning Diagnostic Presentation (January 2016)

• Transportation

No report.

VI. BCN Goals for 2016

Tom Tidwell outlined previous discussions about BCN having a legislative luncheon or breakfast. He’d like it to be in April, after the Legislature’s session is over. He asked for help in organizing it, perhaps twice a year.

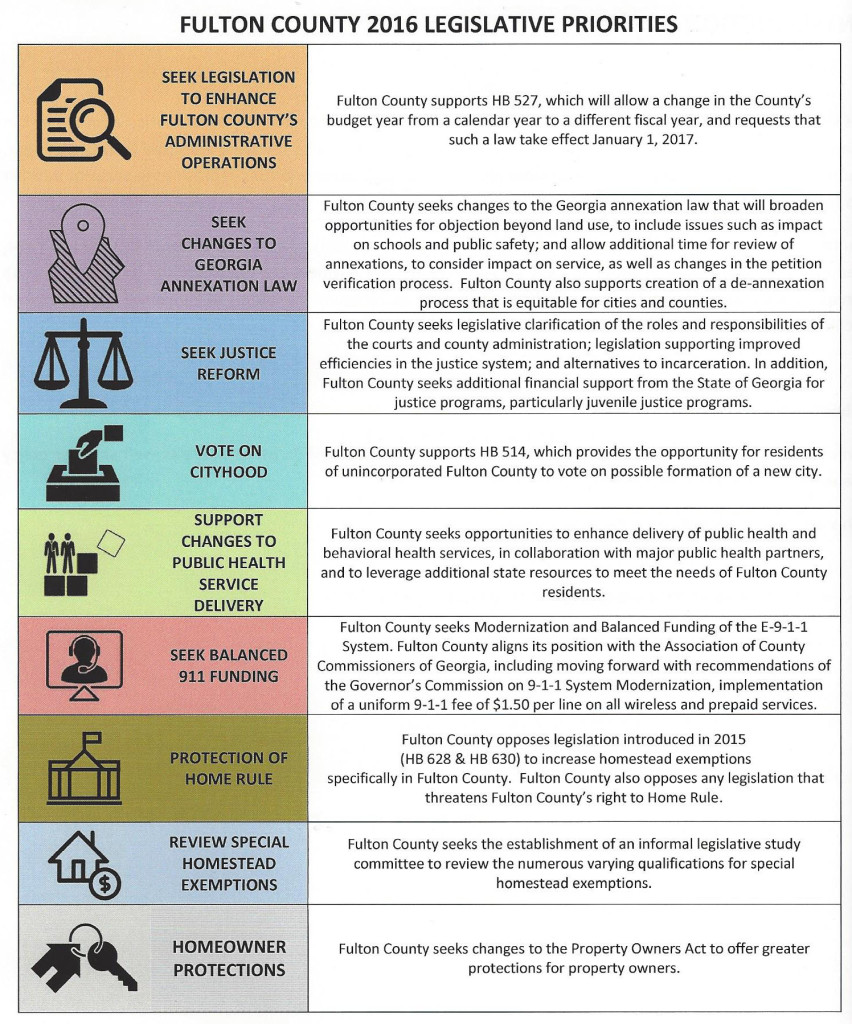

Lee said the county, like the city and the various school systems, put together a legislative package each year. It is a wish list.

VII. Speakers

Lee Morris, Fulton County Commissioner District 3

Fulton Transportation SPLOST: Lee started (and ended) his discussion with the transportation issue which will come up for a vote in November. He said, for some reason, it is not getting a lot of press coverage, but is potentially a big deal. There is a process going on with Fulton and its 14 cities to achieve a consensus for a transportation sales tax proposal for the November ballot. The amount could be one percent or less, in effect for five years, and could raise as much as $1.5 billion.

Five meetings have been held. Allocation of the funding seems likely to be based on population, though it might alternatively be allocated based on employment, center-lane road miles, or average road spending for the most recent three years. The tax amount favored so far is around .75%. Each city would devise its own list of projects. Because of the five year duration of the tax, major MARTA projects can’t be included because the duration is not long enough to fund bonds. MARTA, however, hopes to get its own .5% tax through 2057 on the ballot to fund its own projects – this is what is driving the Fulton tax to the .75% level. However, state law caps sales taxes a total of 9%. The existing 8% sales tax plus the Fulton .75% and the MARTA .5% would total 9.25%, exceeding the limit. The Legislature is saying they will not raise the 9% cap. Lee said MARTA may be inclined to propose a .25% tax. Firm agreements have not yet been reached. All 14 cities and Fulton have to agree on the allocation basis and the amount of the tax in order for the issue to appear on the November ballot.

Lee will notify Tom of when the next meetings will be held so BCN members can be notified of future meetings.

Fulton Fiscal Year: Lee said when he was on the City Council it drove him crazy as a CPA that they adopted their annual budget in February, after they had spent one sixth of it. So he proposed that the city adopt a fiscal year starting in July. While that change didn’t happen immediately, it was ultimately adopted by the city. Fulton is trying to do the same thing, though its situation is not as bad since they adopt a budget at the end of January. It makes more sense to adopt a budget beginning in July since the county will know more about what its tax revenues and reserves will be. He hopes that change will go through this year.

Annexation: He said last year it looked like the people in unincorporated South Fulton would get to vote on cityhood. Then he said, the City of Atlanta expressed desire to annex selected portions of that area, effectively killing efforts to incorporate the whole area. Annexations are incurring in that area, which upsets some on the Fulton Commission and raising what Lee described as “incredible issues” with the school system. For example, the Fulton school system just built two new schools in the area that the City of Atlanta is trying to annex. The question is, what will happen to those schools? Will APS take them over? What about students of those schools who are just outside the annexation boundaries – what schools will they attend? The county’s position is that they ought to have more “say” in the annexation process.

Lee thinks the South Fulton issue is an important one for people in Buckhead. There are about 100,000 people in unincorporated parts of Fulton County. The county provides municipal services such as police, fire, zoning, code enforcement, and other city-like services. He said the biggest fights on the Commission are about the levels of funding for those types of services – should funds come out of the general fund (so people in Buckhead will help pay for it) or should the services be financed just by the population in the unincorporated areas? He said the Fulton general fund pays for roads in the unincorporated area. This means that citizens of Atlanta pay city taxes for their own city roads as well as paying Fulton taxes for the roads in South Fulton’s unincorporated areas.

Lee’s position is that it would be wonderful if the County got out of the business of providing city services. His fear is that with the existing process, the cities will cherry-pick which areas to annex, leaving the least viable portions of the unincorporated area as a potential new city doomed to failure – the result would be the county would be in the business of providing municipal services forever.

The Legislature may act to block current annexation plans to let the voters of unincorporated South Fulton create a single city. If that doesn’t work, the Legislature’s Plan B might be to carve up all of the South Fulton area and assign each portion for annexation by one of the adjacent cities (Union City, Fairburn, Atlanta, Chattahoochee Hills, etc.).

Justice Reform: Lee talked about the differences between the City of Atlanta (with a strong mayor and a large city council) versus Fulton (with a county manager and no mayor with veto powers and a smaller, seven member County Commission). But there are other differences, with the many separately elected constitutional county officers: the sheriff, tax commissioner, judges, and clerks of superior court – the County Commission sets their budget but can’t tell them what to do. Lee says this legislative initiative is very vaguely worded. The hope is the county can get legislative clarification of the roles and responsibilities of the courts and county administration. Lee is not sure exactly what is being asked for; Fulton is asking for help.

Public Health Service Delivery: Lee said this is potentially a big issue for us. Fulton is the only county in the state with its own separate Board of Health. An audit of the system recommends repealing the legislation that established the separate Fulton board and making the county conform to the rest of the state.

Efforts are also being made with Grady to get a Federal “Waver” whose name he could not recall which could potentially get them $100 million from the Federal Government to provide indigent care, getting more people on Medicaid, and helping those in Fulton and DeKalb who provide funding support to Grady Hospital.

911 Telephone Funding: This initiative deals with various technical aspects of the amount phone companies charge for providing 911 telephone services.

Home Rule Issues: This deals with opposition to the Legislature’s efforts to limit the county’s ability to conduct its own business. This includes opposition to bills which propose to increase homestead exemptions on property taxes. Lee said increases to homestead exemptions might take many Fulton County homes completely off the tax rolls, shifting the tax burden to homeowners in Buckhead and similar areas.

Review of Special Homestead Exemptions: Lee said there were 27 exemptions of various kinds for the elderly. These are based on different taxable income amounts using different definitions of income, and for different age categories. The Fulton Board of Assessors has 14 people handling these complicated exemptions and often the exemption rules are not handled correctly. Lee introduced this item and hopes a study committee can be established to simplify the rules.

Homeowner Protections: This deals with new subdivisions which might be marketed with common facilities such as pools. Sometimes, when perhaps half the homes are sold, the subdivision’s developer might fail, leaving the common areas underfunded. This initiative is intended to prove some kind of relief for such problems.

VI. Community Concerns/New Business/Announcements

No report

VII. Next Meeting February 11, 2016

IX. Adjourn

The meeting adjourned at about 8:00 PM.