BCN Member Version – Login Required (PDF)

I. Welcome & Introductions

Chair Tom Tidwell called the meeting to order at about 6:45 PM. A quorum was present.

II. Approval of Minutes

Minutes of the September meeting were approved.

III. Admit New Member Neighborhoods

No neighborhoods asked to be considered for BCN membership.

IV. Nominations for 2018 Officers

Tom Tidwell reported that there would be no December BCN meeting. The next meeting will be on January 11, during which officers for 2018 will be elected. He said that Ron Grunwald will not be Vice Chair next year due to other commitments. Tom is hoping for someone to fill the Vice Chair position with the intent of becoming Chair in 2019. Tom asked that anyone who is interested should notify him. An email on this topic is planned.

V. Candidate Forum Summary

BCN recently conducted the City Council Forum and Mayoral Forum. Tom thanked Jeff Clark for his key role leading to the success of these two candidate forums, saying he did a great job. Audience applause followed. Tom said the forums were well received by the candidates and everyone else that Tom had talked with.

VI. Fulton County Tax Collections

Speakers:

Lee Morris, Fulton County Commissioner, District 3

Nancy Meister, Vice-chair, APS Board of Education, District 4

Yolanda Adrean, City Council member, District 8

Tom said that the discussion of the delayed Fulton property tax situation would involve three speakers. Fulton County Commissioner Lee Morris would tell us where we are today and how we got here. Then Atlanta Board of Education member Nancy Meister and City Council member Yolanda Adrean would tell us, respectively, about the potential impact on the Atlanta Public Schools and the City of Atlanta.

Where we are now:

Lee Morris started by observing that “this has obviously been a fiasco”. He said property tax bills were mailed “today” (November 9) and are also available electronically. The bills will be dated November 15. The Atlanta portion will be due in 45 days (December 30, 2017). The county portion is due on January 15, 2018.

How we got here:

As background Lee, said the state has made it clear to elected officials that they should not get involved in the assessment process. The proper process is that the county commission appoints a five-member Board of Assessors for a term of four years. There are strict limits on the power of the commission to remove members of the board – basically they can’t be removed except for gross violations. The objective is to create independence on the part of the Board of Assessors. The Board of Assessors hires the Chief Appraiser. Neither that Chief nor the Board of Assessors reports to the County Manager or the County Commission. This means that politics is not involved in the assessment process.

Lee said the County Commission was “a little blindsided” when they were told by the Fulton County Board of Assessors that the growth in assessments would be about an overall 13%. This happened a few days before the updated assessments were mailed. The County Commissioners were aware that as we came out of the recession that property values would rise, so 13% wasn’t surprising. Then, however, it became clear that for 23% of the assessments the increase would be over 50% and an “astronomical percentage were over 20% or 30% … and the outrage came”. Many property owners complained to the County Commissioners as did elected officials, mayors and councils. Some city councils prepared unanimous resolutions and sent them to the Fulton Commission urging them to take the actions they ultimately took. They started having town hall meetings with thousands of attendees. Lee said some of them didn’t have a case: their properties were being assessed at what they were worth, which is what the state law requires. Others complained about exemptions being removed for some reason and about awesome numbers, values that were “out of sight”. He said he walked in a lot of neighborhoods looking the affected houses and there were some real anomalies.

The Fulton County Commission struggled with what to do. Then the County Attorney found an 1880 law that gave the commission the power to correct digests, and that’s what they did, voting to go back to substitute the 2016 tax digest for the new 2017 digest. The 2016 digest had been approved by the Georgia Department of Revenue. Obviously, values had gone up since 2016 but those approved values were closer than the 2017 numbers. The Assessors and Tax Commissioner sent the (2016) digest to the Department of Revenue. Typically, that would have been due by September 1, but the county got an extension. He doesn’t know why it took so long, but the digest wasn’t submitted until October 13. They had been hoping to get tax bills out by October 31, but not hearing from the Department of Revenue, the county filed with the court for a “temporary collection order”. The next day Fulton received “notice of denial” from the state regarding the digest that had been submitted.

The “temporary collection order” typically enables the county to bill 85% of the digest’s value. Such orders aren’t uncommon and often arise when an unusual percentage of assessment appeals have been filed by taxpayers. The judge (overruling the state) gave the county the right to collect 100% of the digest’s value since the number of appeals was not an issue in this case. Question from Tom Tidwell: since it was a temporary collection order, will 2017 taxes change in the future? Lee: No.

In summary, Lee said that the tax bills were now in the mail and taxpayers were encouraged to pay early. Lee said that he has asked the Midtown and Buckhead CIDs to encourage their business property owners to pay the bills as soon as they get them. He said they are also working with banks and mortgage companies to get them to pay taxes associated with escrow mortgage payments as promptly as possible. Lee said those who do not have escrowed tax payments and who want to secure an income tax deduction in tax year 2017 for their property taxes should pay the county tax bill before it is due. Lee stressed that the sooner that money comes in, the better it will be for the school systems and other jurisdictions.

What comes next:

Lee said Fulton will be undertaking an in-depth process review of property tax assessment and digest preparation. He said, as part of the process, every three years the Department of Revenue does an in-depth review of the county’s assessment process. In 2013, the Department of Revenue found Fulton deficient and assessed a $1.7 million fine. In response, the county recently agreed to fund the Assessor’s Office adequately, make sure there’s always a Chief Appraiser in the office, etc. Then the review of the 2016 assessment happened with no deficiencies cited. The next review is in 2019. A provision of the 2013 review was that Fulton will remain in compliance and that the $1.7 million fine is deferred until 2019.

What are we looking for in 2018? Assessments will be just as high as 2017 then, maybe higher. Taxpayers will now have some warning that values have gone up. The county is also trying to improve the transparency of the process – a complaint earlier this year is that the Assessors couldn’t/wouldn’t explain why value had increased so much for specific properties. They are going to try to explain better.

Lee said he was struck by an ARC survey that reported that half of Metro residents can’t afford to pay a $400 emergency bill – they’d have to borrow the money. He said that many in the town hall meetings complained that their 50% increase meant that their $1,000 tax bill with the typical rollback of millage rates could become an unaffordable $1,400 tax bill – they would have to skip eating or buying medicine.

Lee commented that even if they hadn’t substituted the 2016 digest for the 2017 one, they would probably have ended up in the same place with the digest being rejected because of excessive appeal levels.

In a few months, in the General Assembly, a bill is likely to be submitted which would extend the “floating homestead exemption” provisions. Lee said there is a CPI-based homestead exemption which applies to Fulton County general fund taxes and Sandy Springs taxes. That exemption says something like, if your assessment goes from $500,000 to $600,000, then your homestead exemption goes up by $100,000 minus 3% CPI adjustment. The plan is to extend that floating exemption to Fulton County Schools and all North Fulton cities. There are no plans to do likewise for Atlanta and APS.

There will also be consideration of the controversial extension of school tax exemptions for seniors to APS. The senior exemption is common in surrounding counties.

Lee also distributed a handout (reformatted below for these minutes) which showed some various legal provisions through which income Fulton county seniors may be exempt from parts of their property taxes.

| Exemption applies to | Amount of exemption | Income cannot exceed | Must be at least age | Definition of income | Comments |

| Atlanta city | $40,000 | $40,000 | 65 | GA net income | |

| Atlanta school | $25,000 | $25,000 | 65 | GA taxable income for state income tax purposes | In addition to other exemptions |

| Fulton school | $54,000 | $30,000 | 65 | Gross income from all sources | In lieu of other exemptions |

| Fulton county | $4,000 | $10,000 | 65 | Net income as defined by GA law | |

| Fulton county | 50% of assessed for 2 years – renewable | 200% of Federal Poverty Level | 65 | Annual household income | In addition to other exemptions |

| Fulton county | Freeze at prior year value | $39,000 | 65 | Federal adjusted gross income | In addition to other exemptions |

| Fulton county | Full value | Maximum amount under Social Security | 70 | Federal adjusted gross income but only certain retirement and other benefits | |

| Fulton county | $10,000 | Maximum amount under Social Security | 65 | Federal adjusted gross income but only certain retirement and other benefits |

These exemptions are in addition to the $30,000 homestead exemption available to everybody. Some have been in effect for over a quarter of a century and, due to inflation, their impact is some fraction of their original intent. Note that Georgia income taxes have significant exclusions for retirement income (up to $65,000 per person) so a lot of families with apparently high-income levels qualify for some of these property tax exemptions. The exemption criteria vary widely, and the 2018 Legislature may look at standardizing these provisions, especially if we point out this issue to our representatives.

In response to a question, Lee described how the assessment system generates appraisals using mathematical formulas which use data such as square footages. Fulton County’s population is larger than that of six states and with 320 thousand parcels, preparing individual appraisals is not feasible. He said the assessments resulting from the formulas are grouped and compared to recent sales prices in the area to get an adjustment factor. Those adjustment factors are used when official assessments are generated. He said the assessments are clearly not prepared using individual house by house professional appraisals like a mortgage company would use. This approach doesn’t consider all the characteristics of each home such as how attractive or undesirable the land might be. As a consequence, appeals can be expected, especially in the coming year.

Yolanda Adrean commented that the assessors’ office is a “creature of the state” and it doesn’t report to the county and members can’t be fired by the county. If that is the case, why is it that the county is fined when the appraisal process goes wrong? — you clearly don’t have any authority over the process. Why doesn’t the state take responsibility? If the assessors do something wrong, why doesn’t the state go after them rather than look to the county to do so? She said the assessors have a lot of authority and responsibility but have zero accountability. She said citizens should go after the state and tell them the system they created isn’t working. Lee responded that it works in other counties. Yolanda responded that it doesn’t work in Fulton County. Yolanda said that she is also upset that while the homeowners had significant increases business appraisal just went up 16%. She said she has studied the digest for at least a decade. She has seen that the assessors leave the commercial properties alone, and the ones they go after are the citizens who the assessors assume don’t have the wherewithal to hire attorneys. She said she is “so outraged … with the state”. Lee responded that the state tried to create a mechanism that is free of politics to collect taxes based on property values. Part of the problem, though, is that property value is not an adequate measure of an owner’s ability to pay. But that is the system we have, and the assessors who are just normal citizens are doing the best they can do.

What should have been done differently to avoid all of these appraisal problems? First, property owners should have been made more aware by the county that home values were rising and that they should be prepared for “sticker shock” when they open their updated tax assessments. Tom asked if the county had started that information campaign for next year. Lee said they are working on trying to provide more transparency and to develop some software systems so taxpayers will understand the process better, so they will understand the basis of increased assessments. He said they also plan to discuss fixes with the General Assembly such as the “floating homestead exemption”. He thinks the legislative process will generate a lot of awareness of the assessment process.

Yolanda pointed out that state law requires that if increases in the tax digest for existing properties increase the total tax bill on those properties, it must be handled as a tax increase with public hearings, etc. To avoid this, local governments reduce the millage rate, so the same amount of revenue is generated for those pre-existing properties. New properties are taxed using their new appraisals and may generate new revenue without it being considered a tax increase. She said that Atlanta had decreased its millage rate for the eight years she had been in office so that a tax increase has been avoided. A questioner asked if Fulton should copy the practices of other counties which have succeeded in avoiding appraisal problems. Lee said Cobb and other counties use outside consultants to prepare appraisals. He said that is obviously a successful model.

Impact on Atlanta Public Schools:

The meeting shifted to impact on APS: Nancy Meister started by saying that given the delay of tax receipts, APS had to take out a Tax Anticipation Note or TAN. She said their fiscal year starts in July and they have had no revenue. She said that they had met with the Fulton Assessors office in March and were to anticipate a 5% to 7% growth in the tax digest, which is the information they used in planning their 2017 budget. She said the tax bills didn’t go out and they had to take out a TAN which is due to be repaid by December 31. The interest on it is over $400,000. She said they have cash flow issues that get really bad on December 8. In response, her Board of Education decided to furlough everyone but teachers for two unpaid days. She said they have also cut back on bill paying. She said this is a problem that isn’t going away. She has been on the BOE for eight years and for the past three or four years problems like this continue to happen. Something has to be done because the impact is “falling on the backs of kids, it’s falling on the backs of teachers and bus drivers, cafeteria workers. Having to tell people that you’re not going to be paid — we are furloughing you two days in the middle of the holidays is horrible. So we really, really need to come up with a fix.” She said they now look at 2017 and had they known the increase was going to be as large as it was, they could have adjusted their millage rate. Had she been given an accurate forecast in March, she wouldn’t have voted for the budget that resulted in a windfall overbilling of $200 million which was needlessly taken from taxpayers.

Nancy said we all need to work together to get the system fixed. She is disappointed that there doesn’t seem to be a lot of progress being made. She thinks it may need to go to the governor – it’s a state issue after all and we need some help from him.

Jeff Clark suggested that the system be revised so that annual reappraisal be discontinued and a base year be selected. In following years, a CPI or around a 3% increase per year would be applied to those base property values and adjustments were set to sales price for homes that actually sold. The alternate system would be simple and everyone would know what revenues would be coming in year by year. Nancy replied, when we know what we are dealing with, we can budget. Another audience member commented that something very similar was done in California. Taxes would be predictable until the house was sold and an objective value was known.

Another attendee countered that the results of California’s system had undesirable consequences in other ways. A major problem was that people couldn’t afford to move because when they moved to a new house they would face a big increase in their property taxes based on the new house’s price. That caused great disruptions in California’s housing markets and in funding for area schools. Another said, the assessed value does need to be close to the market value.

Nancy said she was told by one of the assessors that Fulton didn’t use home sales values. Yolanda agreed, saying they use a formula and overall house price trend adjustments for the neighborhood. Nancy (being a realtor) that not using the sale price absolutely makes no sense. She indicated that rather than using the existing formula system it could be more effective and accurate to use a service like Zillow and Trulia. She said with tools we could probably do Fulton County properties in a week – “It’s not brain surgery.”

Tom said when he moved to Morningside, he paid taxes based on the price he paid for the house. However, his neighbors who had lived there for thirty years were paying a small fraction of what he was paying. Tom continued that, with the original 2017 assessments, his neighborhood didn’t get 80% increases across the board. While his assessment went up by 18%, one of his neighbors did get an 80% increase. He is not sure why his neighborhood is so disparate. Lee said that is part of the testimony that they heard at town hall hearings. Lee said his assessment went up 67% while his neighbor got 0% and the one across the street, which is bigger than Lee’s, went down.

Nancy said the best thing everyone here can do is to go back to your neighborhood. Tell your neighbors to pay their taxes early and if their tax payments are escrowed, contact their mortgage company and ask them to release those funds so school taxes are paid as soon as possible. She said APS needs to pay off the TAN loan by the end of the year and that they have other bills to pay. If somehow, we can all push that message out, it would be great.

Matt Westmoreland commented that this tax problem hits school systems disproportionately. He said for Fulton County schools and APS that 72% of their revenue comes from property taxes. Lee said the Fulton County is about the same as the school system. He said they have also taken out a TAN loan. He added that they don’t get much sales tax revenue since it mainly goes to the cities. Lee said Fulton County Schools did not take out a TAN, but they will likely be “short”.

Nancy was asked, can APS build up a reserve like the city has? She said APS has a 7.5% reserve. But this is not a reserve issue, it is a cash flow issue. Like Matt said, 72% of our revenue comes from property taxes. 65% of APS’ spending is for salaries. Matt added that by state law school systems can have up to a 15% reserve (unlike the unlimited reserves available to cities) and by internal policy APS has a 7.5% floor on the amount of reserve they budget for. Matt said they have a reserve of about $80 to $90 million for the past four years but they spend $70 million a month.

Impact on City of Atlanta, Fulton County and other cities:

Tom asked Yolanda if the city was in the same dire position. She answered, “No we are not. We have plenty of reserves. We don’t have to borrow any money. There won’t be any tax appreciation notes needed by Atlanta. But, it is important to other cities, especially new cities and cities with smaller tax bases. It is a crisis for a lot of municipalities. But, we’re OK.” Lee said that the new city of South Fulton has $0. Fulton is loaning money to South Fulton and South Fulton needs the tax income to repay Fulton.

What can BCN do?

Jeff Clark suggested that BCN member neighborhoods need to contact state representatives to get them involved in clarifying/fixing this property tax policy issue during the 2018 session. Yolanda said the Legislature is only in session for 40 days, so it’s not premature for this body to do something now. Tom said it is the Atlanta Delegation that we really need to involve.

Tom then asked, who is the decision maker who can declare the right way to go? The governor? Lee said, it may be the Local Delegation, but Dick Henderson, the County Manager, have put this issue at the top of their agenda. He said that Dick Henderson has a commercial background (AT&T) and has a passion for government and efficiency. He ran GRETA for a while and then worked with the Federal Reserve in Washington and cut out all kinds of overhead. Since coming to Fulton, Lee said Henderson has had “mind boggling” success at cutting costs and improving service. Lee said Henderson is committed to making sure this tax situation doesn’t happen next year.

Nancy asked that neighborhoods be informed that the graduation rate at North Atlanta is 94.5%, up significantly. All the schools we are paying for in this cluster are doing really well.

Tom suggested that since we are not having a December meeting we should try to set up a meeting with the right officials, whether it’s Dick Henderson or the City Delegation, especially key people such as Deborah Silcox and Beth Beskin. Jeff made a motion that BCN representatives meet with key officials and depending on the outcome of those discussions, prepare a BCN position for an approval vote by BCN member neighborhoods. The motion was approved unanimously by the meeting’s quorum.

VII. Get out the Vote for Runoff on December 5

Speaker: Justin Wiedeman, CPA

– Sargent Advisory Group, LLC

Tom commented that turnout in the general election was low and that every vote matters. He cited one election where a candidate won by seven votes.

Justin said that Buckhead turnout in was about 33% while the city-wide turnout was 30%. This is about average for recent non-presidential elections. Atlanta has 290,735 registered voters, of which 62,507 are in Buckhead.

He said there are ways to reach out to those who are registered but didn’t vote. That’s what his volunteers plan to work on. He is heading a non-partisan effort to organize Buckhead volunteers to contact their neighbors and encourage them to vote on December 5.

The number voting early in the general elections was 21,000 or about 22%. Early voting this time is from November 27 through December 1. Early voting locations haven’t been identified yet.

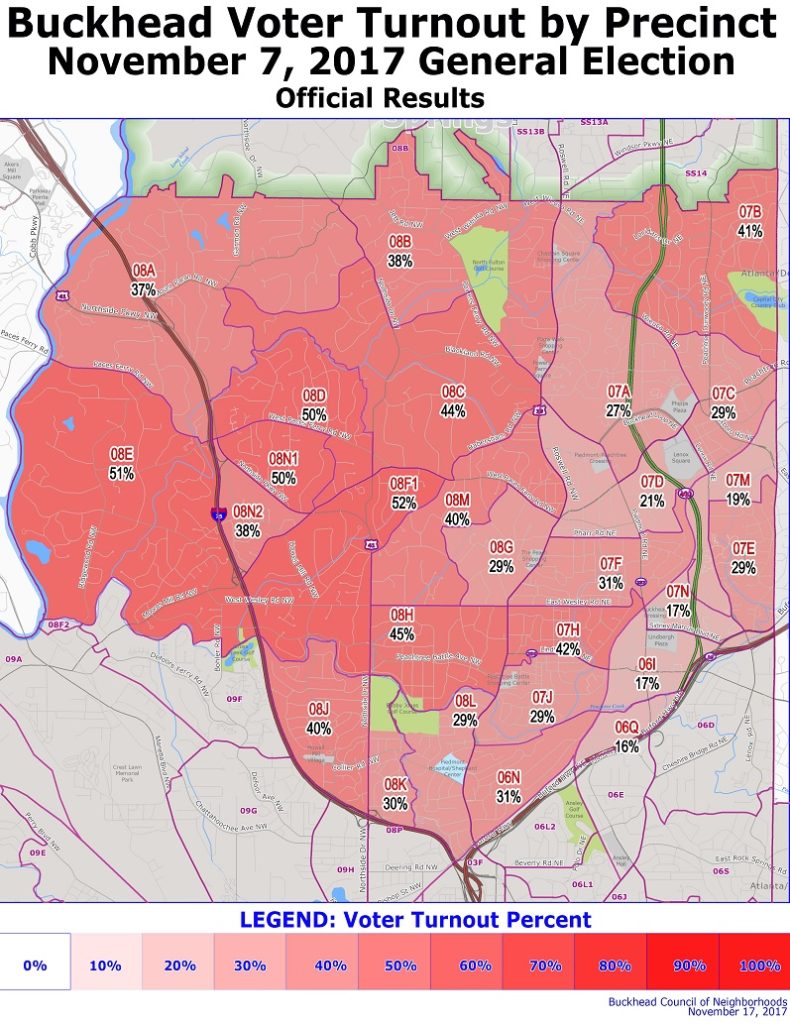

Justin showed a report of unofficial turnout percentages by Buckhead precinct. These have been turned into a map using official results. The map uses color to show varying levels of turnout in Buckhead.

Justin passed around sign-up sheet for people to volunteer to contact neighbors in their vicinity who were registered but did not vote on November 7. We need to encourage them to show up this time. If you are interested in volunteering, click here to email Justin.

VIII. Community Concerns I New Business / Announcements

IX. Next Meetings

BCN Board Meeting: January 11, 2018 – No regular meeting in December

X. Adjourn

– The meeting adjourned at about 8:15 PM.

Note: The opinions expressed by the speakers and individual neighborhood representatives in these minutes do not necessarily represent those of BCN or its member neighborhoods.